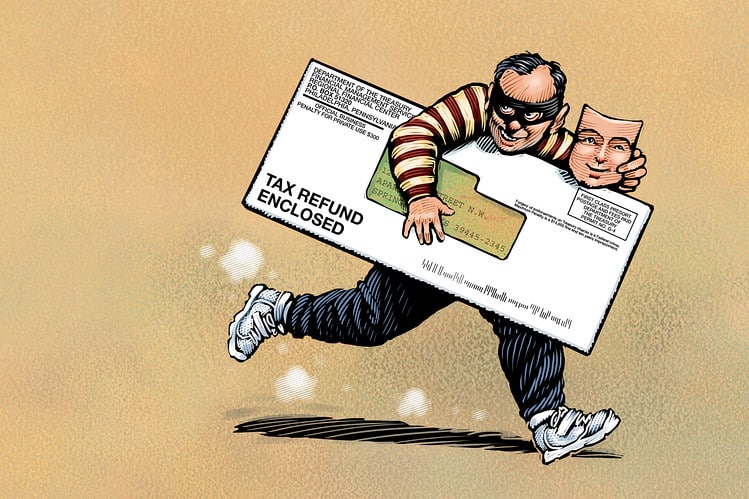

Preventing Tax-Related Identity Theft

With the dawn of each new year comes the dawn of a new tax season and, unfortunately, the potential threat of tax-related identity theft. This theft occurs when someone steals and uses your personal information to file a tax return claiming a fraudulent refund.

Consider these signs of possible tax-related identity theft from the Internal Revenue Service (IRS) and take action if you think you’ve fallen victim:

• You receive a letter from the IRS inquiring about a suspicious tax return you didn’t file.

• You can’t e-file your tax return because of a duplicate Social Security number.

• You get a tax transcript in the mail that you did not request.

• You receive an IRS notice that an online account has been created in your name.

• You receive an IRS notice that your existing online account has been accessed or disabled when you took no action.

• You get an IRS notice that you owe additional tax or refund offset, or that you have had collection actions taken against you for a year you did not file a tax return.

• IRS records indicate you received wages or other income from an employer you didn’t work for.

Keep in mind, the IRS will NEVER Initiate contact with taxpayers by email, text, or social media to request personal or financial information; call taxpayers with threats of lawsuits or arrests or call, email, or text to request taxpayers’ Identity Protection PINs.

If you feel your personal information has been compromised and you’ve become a victim of tax-related identity theft, you have options. For a complete list of action steps and prevention methods, please visit www.irs.gov.