Spring Newsletter 2023

|

A more REWARDING way to bank!Open a FREE iChecking account and earn up to 5.00% APY* on your average daily balance every time you use your iChecking debit card. Simply swipe and earn. Plus, you’ll enjoy: • No minimum balance Learn more and open your iChecking account today! *Annual Percentage Yield | $25 minimum to open. Limit one (1) iChecking dividend-bearing account per membership. The iChecking Annual Percentage Rate (APR) and Annual Percentage Yield (APY) may change at any time, as determined by the Credit Union Board of Directors. The iChecking APR and APY are based on the number of Point of Sale (POS) transactions that post to the account during the calendar month. The dividend rate will be paid on the average daily balance for the calendar month, up to $10,000. Any amount of the average daily balance above $10,000 will earn the current Premier Checking Account APR and APY. The iChecking minimum average dollar transaction is $5.00 to qualify for the monthly transaction count. In addition to meeting the POS transaction requirements, the member must also meet the following conditions in order to qualify: log into Online Banking or the MidSouth Mobile app at least once per month; be enrolled in eStatements; maintain a valid email address; and have a direct deposit posted to the iChecking account within the calendar month of which dividends are posted. Membership requirements apply. |

Convenient. Flexible. Rewarding.

|

|

|

Looking for extra money? Start at home!Home Equity Line of Credit No matter if you need extra cash to cover your home improvement projects, consolidate your debt, or fund your next vacation getaway, you can likely find it right at home. You can use the equity you’ve built up in your home to cover just about any expense you can think of. • Introductory rate as low as 2.99%* APR for the first 6 months Find the money you need today by applying for a home equity line of credit! Qualification is based on an assessment of individual creditworthiness and our underwriting standards. Program, rates, terms and conditions are subject to change without notice. Membership requirements apply. *Annual Percentage Rate | Introductory rate as low as 2.99% APR is fixed for the first six (6) months. Applicable rates apply after the introductory period. Rates listed are our best rates based on credit approval and our lending requirements. Actual interest offered may be higher depending on applicant’s credit rating and other underwriting factors. APR will vary depending on individual credit history. Annual Percentage Rate as low as Prime + 0%. Rates are variable and based on Prime as published in The Wall Street Journal, with a ceiling of 18.00%. **If loan is closed within first 24 months, borrower will reimburse the credit union for closing costs. Minimum $10,000 initial advance. ***Property must be primary residence and located in the state of Georgia. Neither modular, nor mobile homes are eligible. |

Don’t wait on snail mail to get your finances in order. Enroll in eStatements today!By enrolling in eStatements, you’ll have your financial statements archived in your online banking for easy retrieval, review, and download. No more waiting for the mail or sorting through the papers. Simply open the file, review your transactions, and save to your PC. To enroll, log into online banking, select eStatements from the Accounts menu and follow the steps to register. |

|

|

Our Scholarship deadline is approaching!If you or a member of your family is headed off to college in the fall, apply for the Tom Bentley Memorial Scholarship program to see if you can earn funding to help with your continuing education expenses. Graduating High School Senior Scholarship – A $4,000 scholarship ($1,000 per year) will be awarded to one winning applicant. Continuing Education Scholarship – A $2,000 scholarship (not exceeding $500 per semester) will be awarded to one winning applicant. Completed applications and supporting scholarship documentation must be received by the credit union by Friday, April 28, 2023. Applications can be downloaded online. |

Scam Alert! Spoofing is on the rise.Scam alert! Spoofing is when a caller falsifies the data transmitted to your caller ID display to disguise their identity. Scammers often spoof a number from a company or a government agency (even the credit union) so you believe the caller is someone you trust. If you answer, they use scam scripts to try to steal your account access, data, and money. This is a reminder that the credit union will never call, text, or email you asking for account access information or other sensitive data. If you receive such a call, do not ever provide this information! Learn more about spoofing here: https://bit.ly/3HvJsfa |

|

|

Put your tax refund to work for you!Getting a refund this year? Before you spend it, consider these 7 ways to use that money more wisely. 1. Start an emergency fund – Aim to set aside 3-6 months’ worth of living expenses. 2. Further your career – Invest in additional job training, tuition, a work-related conference, or membership in a professional organization that could enhance your future paychecks. 3. Pay off debt – Start paying those debts with the highest interest rates; eliminating these will save you the most money in the long run. 4. Invest – Invest your funds in an IRA, the stock market, real estate, or another account that can grow your money faster. 5. Start (or add to) a college fund for your kids – It’s never too early to start a fund for your child’s higher education expenses. 6. Home ownership – Buying a home? Use your refund to increase your down payment to avoid private mortgage insurance and reduce the amount of your mortgage. If you’ve already got a mortgage, make extra payments to reduce the principal. 7. Make home improvements – Make your home more functional while increasing its resale value. |

When should you take your Social Security benefits?Whether you’re on the brink of retirement or just planning ahead, you may be wondering when you should take your Social Security benefits. There is no “best age” for everyone. Each individual should make an informed decision about when to apply for benefits based on their personal situation. Individuals can start receiving Social Security retirement benefits as early as age 62, however, you are entitled to full benefits when you reach your full retirement age. And, if you delay taking your benefits from your full retirement age up to age 70 years, your benefit amount increases. On the flip side, if you start receiving benefits early, your benefits are reduced a small percent for each month before your full retirement age. If you’re weighing your options about when to take your Social Security, you’ll want to make an informed decision. Take your time to consider some of the following factors before making your choice. • Are you still working? An important thing to remember is the amount you receive when you first get your benefits sets the base for the amount you will receive for the rest of your life, so consider your options carefully and decide on what’s best for you and your personal situation. A representative of MidSouth Financial Consultants is onsite to provide advisement on retirement planning. Learn more about their services or schedule a meeting to discuss your financial needs. For more information on Social Security benefits, visit www.ssa.gov. |

|

|

Brookdale Resource Center DonationMidSouth Community FCU team members gather each Presidents’ Day holiday for annual training. During this year’s meeting, team members donated items to the Brookdale Resource Center. In partnership with United Way of Central Georgia, Brookdale serves as a transitional housing and resource center for people experiencing homelessness in Central Georgia. Brookdale Resource Center’s 90-day program focuses on equipping residents with the skills necessary to achieve financial stability and obtain permanent housing. Each resident at Brookdale has a caseworker who tailors their program to meet their specific needs. They assist with enrollment in school, obtaining vital documents such as birth certificates, and registering residents for government benefits. Visit the Brookdale Resource Center webpage to learn more about the program and how you can make an in-kind donation.

|

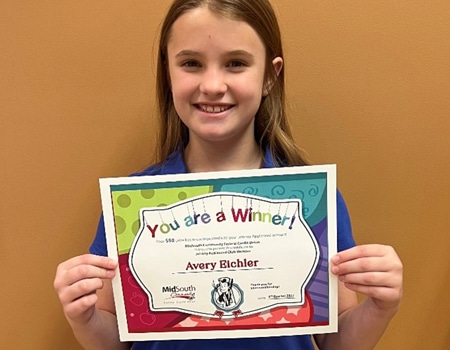

Johnny Appleseed WinnerCongratulations to 10 year old, Avery Eichler, for being selected as the 4th Quarter 2022 Johnny Appleseed Birthday Winner. Avery received a $50 deposit into her Johnny Appleseed account. |

|

|

Holiday ClosingsMemorial Day: Monday, May 29, 2023 Juneteenth: Monday, June 19, 2023 Independence Day: Tuesday, July 4, 2023 |