Winter Newsletter 2023

|

You’re going to fall in love with our digital banking upgrade!Coming in February 2023, exciting upgrades will be made to our MidSouth Mobile app and online banking platform which promises more functionality, an improved user experience and enhanced security controls. Additional information will be shared in the coming weeks. In the meantime, be sure to visit our online Resource Center for more information and for steps you can take to help make the transition easy and seamless. |

Feeling anchored down by holiday debt?Release the anchor with a Debt Consolidation Loan. A consolidation loan is a solution to managing multiple payments and higher interest debt. Consolidate debt into one, lower-cost payment to simplify your finances and pay down debt faster. Borrow up to Rates as low as Apply online or speak with a Lending Specialist at 478.475.7819. *Loans subject to credit approval. **Annual Percentage Rate | Rates as low as 9.90% APR & based on credit approval & our underwriting standards. Actual interest offered may be higher depending on applicant’s credit rating & our underwriting factors. Rates, terms & conditions are subject to change. Membership requirements apply. Equal Opportunity Lender. |

|

|

Save the date for this year’s Annual MeetingMidSouth Community FCU members are invited to participate in our 2023 Annual Meeting. We will share about the progress we made throughout 2022 and outline the goals and plans we have for the future. Date: Thursday, February 16, 2023 Mark your calendar now and plan to attend. We look forward to seeing you! |

There’s a New Way to PayNow you can easily, securely, and privately pay for your everyday items in stores, in apps, and on the web using your mobile device. With our Digital Wallet, you can make purchases with the tap of your finger in a simple, secure, and convenient way. Save time making touchless payments with your mobile device. Now pay with Apple Pay®, Google Pay®, or Samsung Pay®. Visit us online to learn more. |

|

|

Now accepting scholarship applicationsMidSouth Community FCU is now accepting applications for the 2023 Tom Bentley Memorial Scholarship. Scholarships will be awarded to a graduating high school senior and a continuing education student. Graduating High School Senior Scholarship – A $4,000 scholarship ($1,000 per year) will be awarded to one winning applicant. Continuing Education Scholarship – A $2,000 scholarship (not exceeding $500 per semester) will be awarded to one winning applicant. Completed applications and required documentation must be received by 5:00 p.m., Friday, April 28, 2023. Applications can be downloaded online. |

Avoid Falling Victim to Text ScamsThe Federal Trade Commission estimates text fraud cost consumers $137M in the first half of 2022. Scammers are using text messages to pose as representatives from financial institutions to steal your money or personal data. The texts are often fake messages that indicate they have information about your account or a recent transaction. The messages might ask you to give some personal information such as how much money you make, how much you owe, or your bank account, credit card, or Social Security number. They might prompt you to call a number where a “representative” is ready to take your information or tell you to click on a link to learn more about the issue leading you to a spoofed website that looks real but isn’t. If you log in, the scammers then might steal your username and password. How to protect yourself

|

|

|

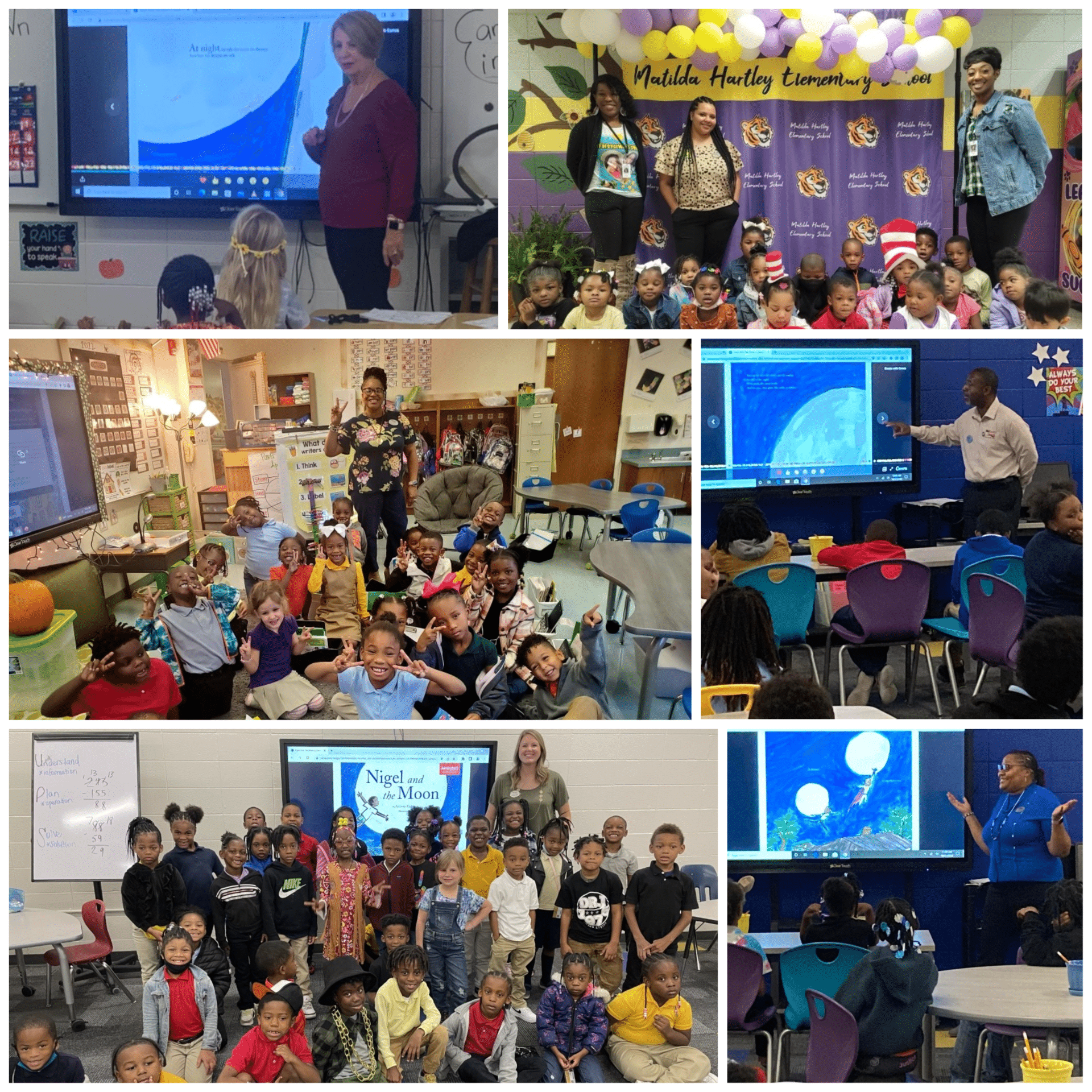

Read for the RecordEach year Read for the Record brings together millions of adults and children as they read the same book on the same day, building an intergenerational community through reading. In partnership with United Way of Central Georgia’s Read United initiative, volunteers read the book Nigel and the Moon to elementary students of the Bibb County School District. Pictured: MidSouth Community employees reading to various elementary classes.

|

Johnny AppleseedCongratulations to 6 year old, Lily Brown, for being selected as the 3rd Quarter 2022 Johnny Appleseed Birthday Winner. Lily received $50 deposited into her Johnny Appleseed account.

|

|

|

SAVE MONEY.

|

Which budget is best for me?The dawn of a new year coupled with continued inflation may have you searching for a new budgeting method. Consider the following tried and true strategies that can help you achieve your financial goals. 1. Envelope Budget – Figure out how much you want to spend in discretionary categories like groceries, dining out, clothing, and miscellaneous purchases, and then put the cash into separate envelopes that are designed for the different types of spending. Once the monthly cash for each category is gone, it’s gone. 2. Zero-Based Budget – Calculate your total earnings in one column and total expenses in another. Whatever is left is then allocated toward goals such as debt repayment, savings, or investments down to $0. 3. 50/30/20 Budget – 50% of your total income goes to needs (housing, utilities, insurance); 30% goes to wants (dining out, entertainment) and 20% goes to savings to include investments or debt repayment. 4. Debt Repayment Budget – Decipher your income and compare to your expenses and minimum amounts due on loans. You pay all bills you need to pay and then allocate the extra toward paying off debts – focusing heavily on those with the highest interest rates first. No matter which budget method you choose, creating one can help you to better manage your spending and further your progress toward your long-term financial goals. |

|

|

Holiday ClosingsNew Year’s Day (observed): Monday, January 2, 2023 Martin Luther King, Jr. Day: Monday, January 16, 2023 Presidents’ Day: Monday, February 20, 2023 |