SAVING FOR WHAT MATTERS MOST

Since 2007 America Saves Week has been an annual celebration as well as a call to action for everyday Americans to commit to saving successfully.

We recognize that Savers all have unique circumstances, and even if they are in a scenario that makes it difficult or impossible to save at this moment — they are committed to doing the work, taking control of their finances, and becoming more financially stable.

We all have unique circumstances – in many cases it makes it difficult, or nearly impossible for many to save at this stage of their lives. People that are still committed to doing the work, taking control of their finances, and becoming more financially stable – in every stage of life.

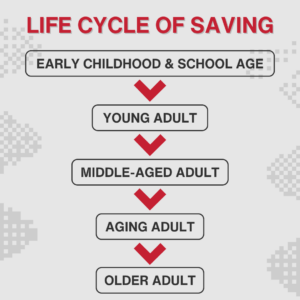

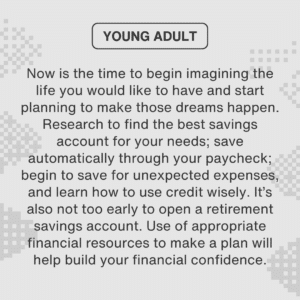

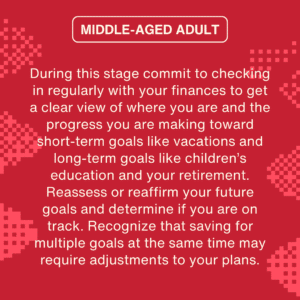

Spending and saving habits naturally change over the course of your lifetime. How we approach money evolves from childhood to retirement and depends on our circumstances at every stage.

TAKE THE PLEDGE

Make saving a priority in your life by taking the pledge to set up automatic savings or increase your current automatic savings amount. Take the pledge here.

A great place to start building your financial confidence is to set up automatic savings. When you are saving a dedicated amount of money every week, every month, or on some other regular interval, you can begin to feel a sense of control over your saving habits. Whether you are saving just $5 or $10 a month or more, it’s the fact that you’re doing it automatically that is important.

Saving automatically is the formula for successful saving for anyone – including you. Getting started doesn’t have to be a hurdle either. Consider which one of the following two strategies would work best for you and follow the steps we’ve outlined.

- Instructing your employer to split your directly deposited paycheck into two or more accounts at your financial institution with one account being a dedicated savings account.

- Directing your financial institution to automatically transfer money into your savings account.

How often have you heard that saving for life’s unexpected events is very important and a necessary part of being financially prepared? Most likely A LOT!

Here are a few strategies to consider that may help you build your financial confidence and begin or continue on your path to saving for the unexpected.

- Set a goal of saving $500 for emergencies and once you reach this amount, set a new goal for another $500 and keep going. Reaching several smaller goals feels good and when we feel good, we’re more likely to remain committed to our plan.

- Instead of only focusing on the negative reasons for having an emergency savings account, think of it as saving for opportunities. Framing the reason you are saving in a more positive light may help you feel better about setting money aside. Not only are you saving to pay for car repairs, home expenses, or medical bills, tell yourself you are saving for an unplanned dinner out to celebrate a friend’s birthday or the chance to go see your favorite artist in concert.

- Use the three to six months of expenses in a savings account as a guideline. Try not to become discouraged if you haven’t met this level. Instead, focus on what makes the most sense for you at this time, knowing that as your income grows and/or expenses decrease your ability to save more and more quickly will change.

Have an Emergency Fund

Having an emergency savings fund of at least $500 may be the most important difference between those who manage to stay afloat and those who sink into debt. Having an emergency fund will also give you peace of mind knowing that you can afford to pay unexpected expenses when they pop up. (and they will pop up)

Save for a Down Payment

Although there are currently some home loan options available that don’t require a large down payment, most need at least 3% of the purchase price to be paid by the buyer. Let’s not forget that not everyone qualifies for those loans, leaving many needing a much larger amount to make homeownership a reality.

Save for Retirement

Starting to save for retirement early in adulthood can give you an advantage when it comes to compounding in the long run and is key to having enough stashed away for when the time comes. Ideally, you should start as soon as you get your first job, if possible. The more you save when you are young, the more you’ll have in retirement, which makes for better future financial stability.

It can be hard to know when to focus on paying down debt (the past), saving for current expenses (the present), or saving for things like retirement (the future). America Saves Week team breaks down:

- Why everyone deserves to be debt free

- Different debt techniques that may be best for you

- How to save now to make room for your debt payoff journey

Listen to this episode to learn how to audit your income and expenses so that you can begin your debt payoff journey feeling empowered and excited!

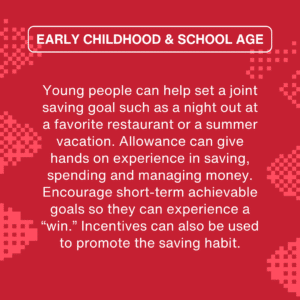

Saving. Do you view it as an ongoing journey? Or do you consider saving as someplace you arrive at? At America Saves we are in the camp that saving is a habit, not a destination. And it’s a habit that can be formed at any age. Whether you are a parent trying to instill this habit in your children or you want to change your own saving behaviors, there are strategies that savers of all ages can develop.

It can be hard to stay motivated when setting aside money for something in the future no matter what your age. It’s easy to focus on what you want in the moment — we don’t want to wait to purchase that expensive pair of sneakers. We want to take a trip in the next three months. Retirement is so far off that it feels OK to spend more of your current income right now and catch up later. In each of these scenarios, we aren’t thinking about our future selves, just who we are and what we want today.

Journeys can take us on many different paths and saving journeys are no different. So stay with America Saves as you and your family embark on a new journey or resume one that encountered a detour. It’s never too late to #ThinkLikeASaver.