Winter Newsletter 2024

|

Bundle up your debt and SAVE!A Debt Consolidation Loan is a great way to bundle multiple high-interest debts into one manageable monthly payment. Borrow up to Rates as low as Bundle up your debt and save now when you apply for a Debt Consolidation Loan! *All credit union loan programs, rates, terms, and conditions are subject to credit approval and may change at any time without notice. **Annual Percentage Rate | 9.90% APR is our lowest rate, based on credit approval and our underwriting standards. Actual interest offered may be higher depending on applicant’s creditworthiness. Membership requirements apply. Equal Opportunity Lender. |

Whatever the need, your home can help!Home Remodeling. Debt Consolidation. Emergency Repairs. College Tuition. Big-Ticket Expenses. Whatever the need, a home equity line of credit allows you to withdraw funds repeatedly, when you need them. • Lines of credit up to $150,000 Apply for your HELOC today. Schedule an appointment with a Branch Manager to get started. Qualification is based on an assessment of individual creditworthiness and our underwriting standards. Program, rates, terms and conditions are subject to change without notice. Membership requirements apply. *Annual Percentage Rate will vary depending on individual credit history. Annual Percentage Rate as low as Prime + 0%. Rates are variable and based on Prime as published in The Wall Street Journal, with a ceiling of 18.00%. The current variable APR as of July 27, 2023 is 8.50%.**Property must be primary residence and located in the state of Georgia. Neither modular, nor mobile homes are eligible. Equal Opportunity Lender.

|

|

||

|

How is your financial health?Just like regular health check-ups, your financial health deserves attention, too! A Financial Check-up with MidSouth Community FCU is a periodic appointment to review your finances with a trusted advisor. We can help you: • Plan your short and long-term financial goals Keep your financial health in tip-top shape. Schedule your Financial Check-up today! |

Save the date for this year’s Annual MeetingMidSouth Community FCU members are invited to participate in our 2024 Annual Meeting. We will share about the progress we made throughout 2023 and outline the goals and plans we have for the future. Date: Thursday, February 22, 2024 Mark your calendar now and plan to attend. We look forward to seeing you! |

|

|

There’s a better way to save for the holidays!Did you rack up unnecessary debt through this last holiday season? We have a better way! Start saving now with a Holiday Club savings account. By opening this special savings account, you can save a little at a time, all year long through payroll deduction. So when the 2024 holiday season arrives, you’ll be ready to knock out your shopping quickly and easily! For more information visit us online, or open your account today.

|

||

Now accepting scholarship applicationsMidSouth Community FCU is now accepting applications for the 2024 Tom Bentley Memorial Scholarship. Scholarships will be awarded to a graduating high school senior and a continuing education student. Graduating High School Senior Scholarship – A $4,000 scholarship ($1,000 per year) will be awarded to one winning applicant. Continuing Education Scholarship – A $2,000 scholarship (not exceeding $500 per semester) will be awarded to one winning applicant. Completed applications and required documentation must be received by 5:00 p.m., Friday, April 26, 2024. Applications can be downloaded online. |

|

|

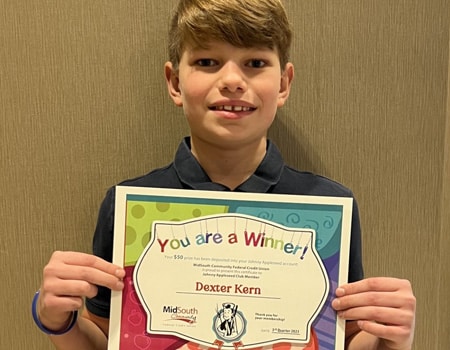

Johnny Appleseed WinnerCongratulations to 10 year old, Dexter Kern, for being selected as the 3rd Quarter 2023 Johnny Appleseed Birthday Winner. Dexter received $50 deposited into his Johnny Appleseed account. |

Exclusive Member Discounts – Just for you!This tax season you can now get the biggest savings on tax prep services and expert tax help. Plus, as a credit union member you can enter for a chance to win $10,000 in the Love My Credit Union® Rewards Tax Time Sweepstakes. TurboTax – Get a bigger discount this tax season with savings of up to 20% on TurboTax federal products. Hand off your taxes, get help from experts or file on your own – with TurboTax, America’s #1 tax preparation provider. Get started with TurboTax today! H&R Block – Get expert tax help and the best-in-market savings up to $25 on H&R Block professional tax prep. Get your taxes done by a tax pro in an office, via video, or by phone – with H&R Block, experience counts. Get your H&R Block coupon now and save! Visit https://taxservices.lovemycreditunion.org for offer details and disclaimers. |

|

|

Guarding Your FinancesFraudsters continue to find new ways to lure consumers into handing over their personal data and/or financial information with each new year. The best way to prevent falling victim is to remain up-to-date of the latest scams. Review these common scam types and prevention techniques to keep your data safe so you can enjoy a fraud-free new year! 1. Email Scams – Scammers can make emails look like they are from a legitimate business, government agency, or reputable organization (even the credit union). NEVER click on links or open attachments in unsolicited emails. 2. Phone Scams – Scammers use AI (Artificial Intelligence) to recreate voices of your loved ones and call you to indicate that loved one is in trouble and needs money. Never trust a call of this sort. Experts recommend families adopt a “code word” system to use in such situations. Always verify the loved one is okay by calling them directly and verifying their whereabouts. If there is an issue, report it to law enforcement. Report any suspicious calls to the FTC. 3. Money Transfer Scams – If you haven’t met a person face-to-face, don’t send them money. This is especially true if the person asks you to transfer funds using a pre-paid debit card or CashApp. Money sent to strangers in this way is untraceable, and once it is sent, there’s no getting it back. 4. Online Payment & Purchase Scams – Don’t shop retailers’ sites you aren’t familiar with. Research the retailer you’re shopping and ensure the site is secure before entering payment information. 5. Personal Data Scams – Never share financial information, birthdate, address, Social Security number, or Medicare number with an unsolicited caller or emailer. 6. Social Media Scams – Use privacy settings on social media and only connect with people you know. Be careful about including personal information in your profile, and never reveal your address and other sensitive information. |

Account AlertsSetting up online and mobile account alerts is essential for financial vigilance. Receive instant notifications on transactions, account balances, and potential fraud, empowering you to manage your money in real-time. These alerts enhance security, prevent overdrafts, and provide peace of mind, ensuring you stay in control of your finances effortlessly. Get started now by logging into online banking or the MidSouth Mobile app. |

|

|

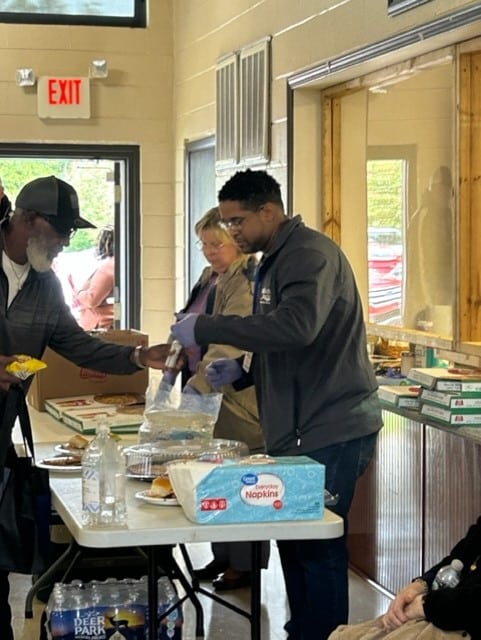

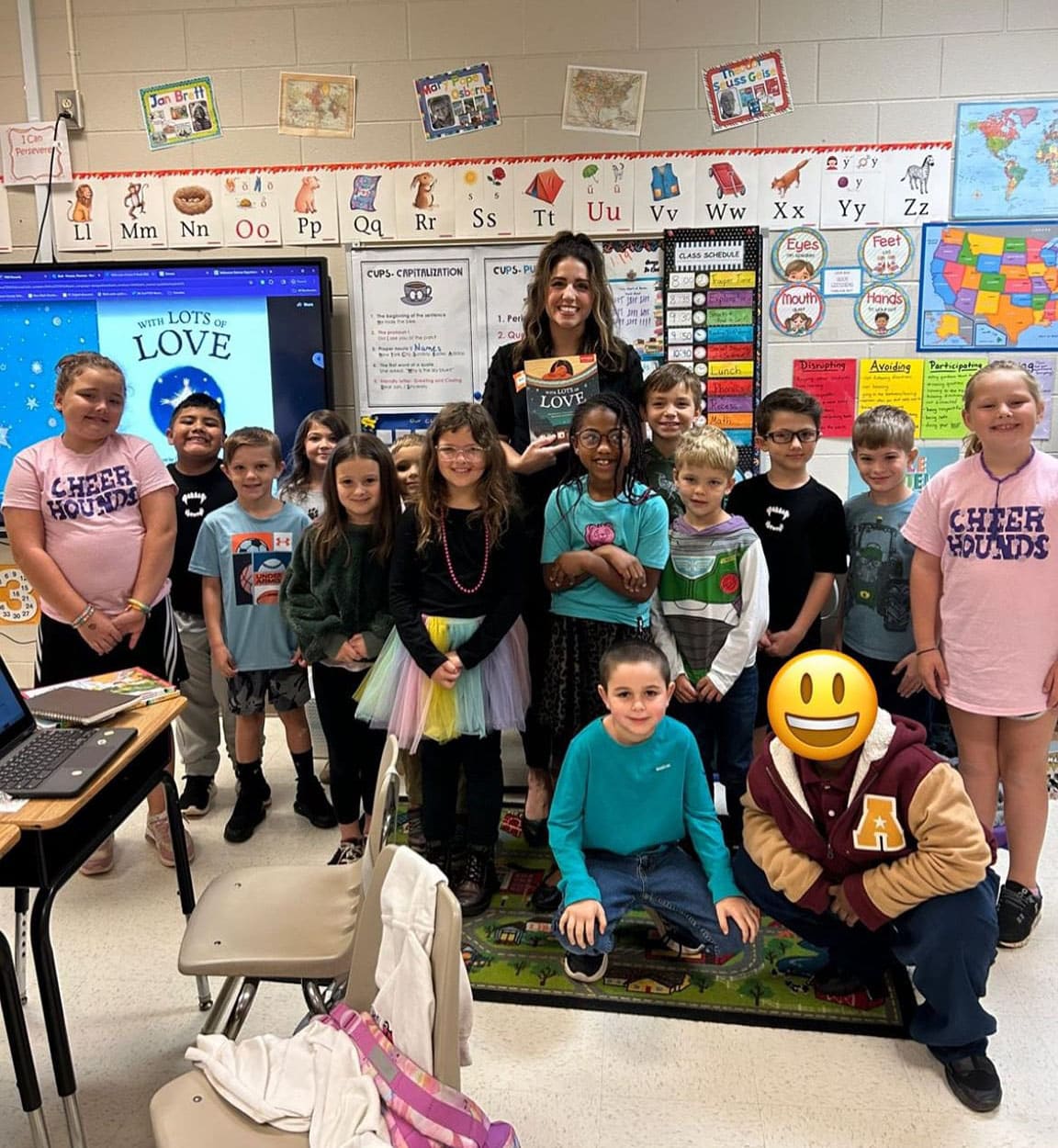

Table Community ChurchSeveral of our Branch Managers recently worked with Volunteers of America at Table Community Church, in Warner Robins. The event focused on serving the less fortunate and homeless community by providing them with bags of food, toiletries, food cards, free cell phones, and haircuts. Representatives were onsite to offer housing services and job assistance. Over 100 neighbors were served in the area on this day. For more information about Table Community Church or Volunteers of America, please visit https://voase.org/.

|

||||||||||||

|

Holiday ClosingsNew Year’s Day: Monday, January 1, 2024 Martin Luther King Jr. Day: Monday, January 15, 2024 President’s Day: Monday, February 19, 2024 |